Depreciation and non-depreciation assets are very important if you want to invest or buy something. You must know the items over time value. In this article, I’ll discuss what asset cannot be depreciated and methods to calculate depreciation over the year. So, without wasting any more time let’s explore.

What Is Depreciation?

Before knowing what asset cannot be depreciated you need to understand what is depreciation. Depreciation is a financial term, when the value of an asset decreases then it is called depreciation.

It is a really important factor to record the cost of an asset over time. Depreciation can also impact taxes because it can reduce tax deductions from income tax. To calculate the depreciation of an asset you need to divide the book value by the units of production excepted from the asset.

What Asset Cannot Be Depreciated?

You learned about depreciation, now you are going to learn what asset cannot be depreciated. So, let’s explore which types of assets cannot be depreciated.

Land

Land is a very secure asset and it is a highly non-depreciable asset. The land is a tangible and indefinite asset life. It can retain its value and increase over time. The unlimited lifespan gives land the advantage of being a non-depreciable asset.

Unlike other assets land is the only asset that cannot be reduced in quantity or quality therefore it is a non-depreciable asset.

Intangible Assets

Intangible assets generally cannot depreciate. You cannot see or touch these types of assets, these lack physical substance and include items like goodwill, trademarks, brands, copyrights, and patents.

These types of assets have an indefinite life span. Instead of depreciation, it can stepped down or you can say it actually amortized.

Investment

Investments in stocks, bonds, and mutual funds are generally considered as non-depreciable assets. These assets are counted as marketable securities which fluctuate based on market condition.

Investments are basically long-term plans so people invest their hard-earned money in an appreciated asset instead of short-term holding so it cannot be subject to depreciation.

Financial Instruments

If you know about trading and can analyze the market then some financial instruments like derivatives, futures, and options, also cannot be a depreciable asset. These types of assets are the same as the previous ones because they are subject to market fluctuations.

And their short-time process is intended to increase their value. They are usually held for speculative or hedging purposes.

Natural Resources

Natural resources are one of the best non-depreciating assets. Oil, gas, Mineral deposits, forest resources, etc. are the best-appreciating assets. Rather than depreciation natural resources are subject to allocate the cost of extraction over the estimated reserves.

What Are Depreciated Assets?

You understand what asset cannot be depreciated, so, what assets are depreciated? Let’s talk about this. Depreciable assets are those assets that generate income just one or two times and then lose their value over time.

Depreciation is used to reduce total taxable income. The depreciation has no effect on cash flow or actual cash balance because it is a non-cash expense. Here are some types of depreciated assets.

- Manufacturing machinery

- Vehicles

- Office buildings

- Buildings you rent out for income (both residential and commercial property)

- Equipment, including computers

How To Calculate Depreciate?

Now you know about ‘what asset cannot be depreciated’ but it is very important to learn how you can calculate the total depreciated amount each year. I’ll show you four methods that help you to calculate the depreciation.

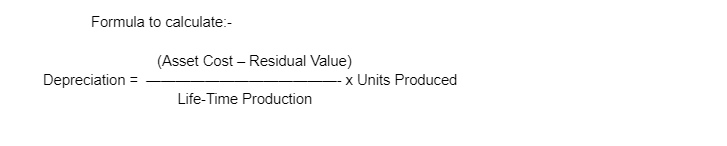

Units Of Production

It is a process to know how much value the asset losing and how many asset units are available or produced. For example, if you purchase a soft drink 1 liter bottle and you drink 0.5 liter from it it loses its value by half of the actual amount.

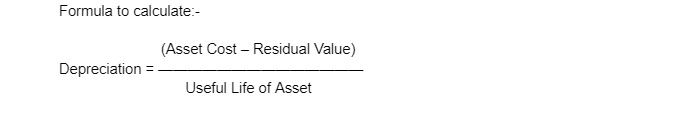

Straight-Line Method

This is the best and easiest way to know what asset cannot be depreciated and calculate the value lost by some asset each year. The straight-line method gives the perfect number of the value that the item lost each year.

The amount will be decreased each year until it touches zero.

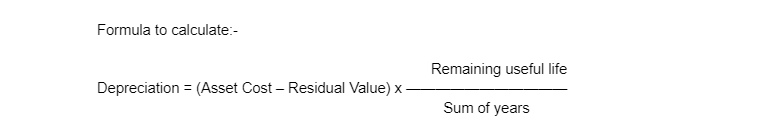

Sum-Of-Year’s Digits

Sum-Of-Year’s Digits method you can assign the total loss of value of that asset over the time that you use it. This method is very interesting because it gives a huge loss in the beginning but later on it shows less loss. For example, if the life is 6 years, we add 1 + 2 + 3 + 4 + 5+6, which is 21.

Double Declining Balance Method

It is a method to figure out what asset cannot be depreciated for that this method allows you to calculate how much the items lose their value each year. This shows the same result as the Sum-Of-Year’s Digits method. In the beginning, it loses its value quickly and slower later on.

For example, let’s assume you purchase a product for $500 andd use it for 4 years. In the first year, it loses a lot of its value and becomes worth $300. Then, in the second year, it loses much value and becomes $150 by the third year the product is only worth $50 after the fourth year it has zero value.

FAQs (Frequently Asked Question) :-

Ans:- Assets such as Land, Collectibles like art, coins, or memorabilia, and Investments.

Ans:- Current assets do not depreciate. However, its market value can fluctuate. Non-current assets usually depreciate over time.

Ans:- The price of gold can rise or fall according to the market. But it is considered as a long-term good investment and gold always maintained its value over the long term.

Ans:-no land is not a non-current asset it is considered a long-term asset. It cannot decrease its value because it does not lose quality and quantity.

CONCLUSION

In the end, now you understand ‘what asset cannot be depreciated’. Calculating the depreciation value of an investment or purchase is crucial. In this article, I covered depreciation assets and how you can calculate them with four different methods. If you have any questions then feel free to comment in the comment section.

Read Also:

- How To Start Blogging?

- How To Start A Virtual Assistant Business

- How To Start A Mobile App Development Company?

- Andrew Tate Net Worth | How Much Is Andrew Tate Net Worth?